monterey county property tax rate 2020

What is the sales tax rate in Monterey County. 2022 Property Statement E-Filing E-Filing Process.

Secured Property Taxes Tax Collector

You can also get additional insights on median home values income levels and homeownership.

. This compares well to the national average which currently sits at 107. The 2018 United States Supreme Court decision in South Dakota v. Effective July 1 2018 The Consolidated Oversight Board for the County of Monterey was established in accordance with the California Health and Safety Code 34179j to oversee the activities of the ten redevelopment successor.

Payments may be made to the county tax collector or treasurer instead of the assessor. The TreasurerTax Collector serves the residents of Monterey County and public agencies by protecting the public trust through the delivery of valuable professional and innovative services in the collection of property taxes. 435 Main Rd PO.

Property Tax Bills and Effective Property Tax Rates on a USA150 Additional Property Tax fo Monterey County 2020 Residential Property Tax Rates For 344 MA Communities Boston. Agency Direct Charges Special Assessments. Box 308 Monterey MA 01245 Phone.

Yearly median tax in Monterey County. Town of Monterey MA. The median property tax also known as real estate tax in Monterey County is 289400 per year based on a median home value of 56630000 and a median effective property tax rate of 051 of property value.

The average effective property tax rate in California is 073. For assistance in locating your ASMT number contact our office at 831 755-5057. The median property tax on a 56630000 house is 594615 in the United States.

The minimum combined 2022 sales tax rate for Monterey County California is 775. At any time prior to submitting the Statement for E-Filing you may printsave a draft copy for your review. The median property tax in Monterey County California is 2894 per year for a home worth the median value of 566300.

Box 308 Monterey MA 01245 Phone. Monterey County collects on average 051 of a propertys assessed fair market value as property tax. Checks should be made payable to.

Single Family Dwelling wGuestGranny Unit and Bath. California property taxes are based on the purchase price of the property. Monterey County Treasurer - Tax Collectors Office.

The property tax rate used by the Auditor-Controller include. What triggers a transfer tax. 775 Is this data incorrect The Monterey County California sales tax is 775 consisting of 600 California state sales tax and 175 Monterey County local sales taxesThe local sales tax consists of a 025 county sales tax and a 150 special district sales tax used to fund transportation districts local attractions etc.

The median property tax on a 56630000 house is 419062 in California. Approximately 129000 parcels of property account for 838000000 fiscal year 2020-2021 in revenue for the County public schools cities and districts. So if your home is valued at 1000000 the transfer tax would be 1100.

The median property tax also known as real estate tax in Monterey County is 289400 per year based on a median home value of 56630000 and a median effective property tax rate of 051 of property value. Tax amount varies by county. MONTGOMERY COUNTY REAL PROPERTY TAX SERVICE AGENCY Sandy Frasier Director County Annex Building Fonda NY Phone 518 853-3996 MONTGOMERY COUNTY 2020 TOWN AND COUNTY TAX RATES town and county tax rates for 2020xlsx Prepared by Montgomery County Real Property 12312019 840 AMPage.

Counties in Maryland collect an average of 087 of a propertys assesed fair market value as property tax per year. PROPERTY TAXES IS THIS FRIDAY. The Monterey County sales tax rate is 025.

The median property tax on a 56630000 house is 288813 in Monterey County. A transfer tax is imposed on documents that show an interest in property from one person to another person. The total sales tax rate in any given location can be broken down into state county city and special district rates.

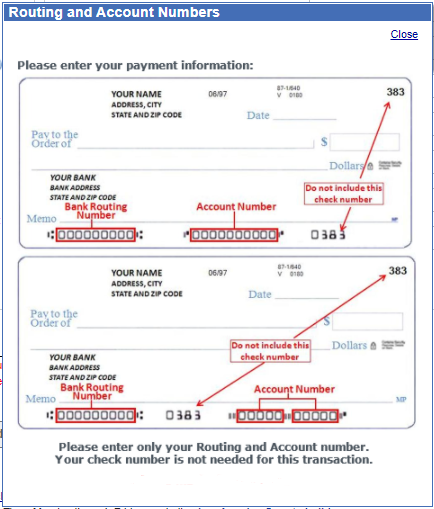

Below is an example and description of the information you can find on your property tax bill. Monterey County collects on average 051 of a propertys assessed fair market value as property tax. Monterey County Tax Collector.

Click to see full answer. Monterey County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property tax. The sales tax jurisdiction name is Monterey Conference Center Facilities District which may refer to a local government division.

051 of home value. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on. 435 Main Rd PO.

California has a 6 sales tax and Monterey County collects an additional 025 so the minimum sales tax rate in Monterey County is 625 not including any city or special district taxes. The median property tax in Maryland is 277400 per year for a home worth the median value of 31860000. 087 of home value.

Town of Monterey MA. Secured taxes make up the majority of monies collected by the Treasurer-Tax Collector. Where do Property Taxes Go.

Below is a list of the top ten taxpayers in Monterey County for Fiscal Year 2020-21. Monterey County Stats for Property Taxes. Monterey County has one of the highest median property taxes in the United.

So when you buy a home the assessed value is equal to the purchase price. How Property Taxes in California Work. CITIES TAX RATE Marina 2015 GO Refunding Bonds 0022180.

When you have completed the E-Filing process you should printsave a final copy of your Property Statement for your own records. The California state sales tax rate is currently 6. 630 PM PDT Apr 8 2020.

The Monterey County Tax Assessor can provide you with a copy of your property tax assessment show you your property tax bill help you pay your property taxes or arrange a payment plan. This is the total of state and county sales tax rates. Welcome to the E-Filing process for Property Statements.

For an easier overview of the difference in tax rates between counties explore the charts below. This table shows the total sales tax rates for all cities and towns in. The median property tax in Monterey County California is 2894 per year for a home worth the median value of 566300.

025 lower than the maximum sales tax in CA. When making a payment by mail please be sure to include your 12-digit ASMT number found on your tax bill. That means the state levies a transfer tax of 055 per every 500 of home value.

IN MONTERE COUNTY THE TAX COLLECTOR THERE SAYS HER OFFICE IS BEIN FLOODED WITH CALLERS ASKING IF. The 925 sales tax rate in Monterey consists of 6 California state sales tax 025 Monterey County sales tax 15 Monterey tax and 15 Special tax. Page 7 Property Tax Highlights FY 2020-21.

Riverside County Ca Property Tax Search And Records Propertyshark

How To Transfer California Property Tax Base From Old Home To New

What Is A Homestead Exemption California Property Taxes

Additional Property Tax Info Monterey County Ca

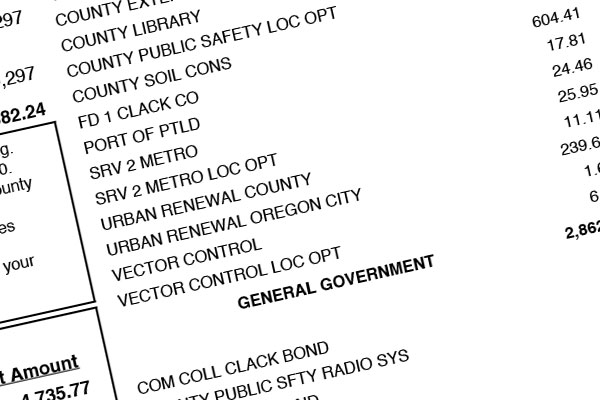

Assessment And Taxation Clackamas County

How To Calculate Your Tax Bill

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

Pin On How To Invest In Real Estate

How Much Is Property Tax In California Caris Property Management